Fulfilling Your Total Healthcare Needs

Click Here To Read – ING SPECIAL ATTENTION – H1N1 HOSPITALIZATION CLAIM

With ING MediPlus Insurance, you are covered worldwide 24 hours a day. You need not worry about funding for healthcare costs or it being a burden on yourself and your loved ones. It is designed to give you maximum protection, flexibility and convenience at minimum cost. All you have to do is select from a choice of three IMPlus plans that suit your needs and let it work for you.

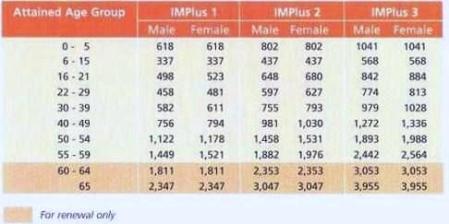

The table below illustrate the annual premium for all 3 plans under the ING MediPlus

(For both genders and on assumption that the applicant’s occupation is standard within ING’s classification)

Comprehensive Hospitalizations & Surgical Coverage

| Schedule of Benefit |

IMPlus 1 (RM) |

IMPlus 2 (RM) |

IMPlus 3 (RM) |

| Hospitalisation & Surgical Expenses | |||

| a) Room & Board (daily limit) |

120 |

180 |

260 |

| b) Intensive Care Unit(Total period for Hospital Room & Board and intensive Care Unit up to a maximum of 60 days per disability) |

300 |

300 |

300 |

| c) Surgical Expenses(Surgical fees, Anaesthetist fee and Operating theatre charges) including post surgical care up to sixty (60) days from date of discharge) |

As charged subject to self-insured deductible |

||

| d) Hospital Expenses | |||

| e) Pre-Surgery/Medical Specialist ConsultationIncludes fees incurred for consultation within 31 days prior to hospital admission or Day Surgery | |||

| f) Pre-Surgery/Medical Diagnosis Test | |||

| g) Daily Cash Allowance at a Malaysian Government Hospital (per disability) |

50 |

50 |

50 |

| Out of Hospital Benefits |

|

||

| a) Day Surgery Benefits |

As charged subject to self-insured deductible |

||

| b) Emergency Accidental Outpatient Treatment – up to 31 days from the date of accident |

As charged |

||

| c) Post-Hospitalisation or Day Surgery Follow up – up to sixty (60) days from date of discharge or Day Surgery | |||

| d) Out- Patient Cancer Treatment | |||

| e) Out-Patient Kidney Dialysis Treatment | |||

| f) Home Nursing Care Limit per disability. Valid within 7 days from the date of hospital discharge, subject to a minimum of 3 days hospitalisation |

500 |

1,000 |

2,000 |

| Overall Annual Limit |

50,000 |

100,000 |

150,000 |

| Lifetime Limit |

150,000 |

300,000 |

450,000 |

**A deductible amount of RM50 is payable by the policyholder. This deduction is applicable per hospital admission/Day Surgery.